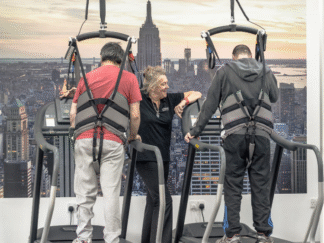

High-Quality Care Services

Established in 2013, we proudly mange a network of 20 trading care companies. With a presence in 100 locations throughout the UK and a workforce exceeding 7,000 care and support professionals, each contributing extensive local care service expertise, we deliver secure, customised, and individualised care and support services to 12,000 individuals with diverse needs.

Our Mission

To deliver exceptional and personalised care to our service users; enhancing their quality of life, independence, and dignity.

Our Objective

To deliver high-quality care that empowers our service users to maintain their independence and dignity while residing in their own homes.

Our partners & accreditations